How To Find Maturity Value In Compound Interest

Enter the master investment, rate of interest, and time of investment into the calculator. The estimator will determine the maturity value of the investment.

- Yield To Maturity Estimator

- Bond Equivalent Yield Estimator (+ Formula)

- Constructive Annual Yield Calculator

- Maturity Gap Calculator

- Bond Conveying Value Figurer

- Modified Elapsing Reckoner

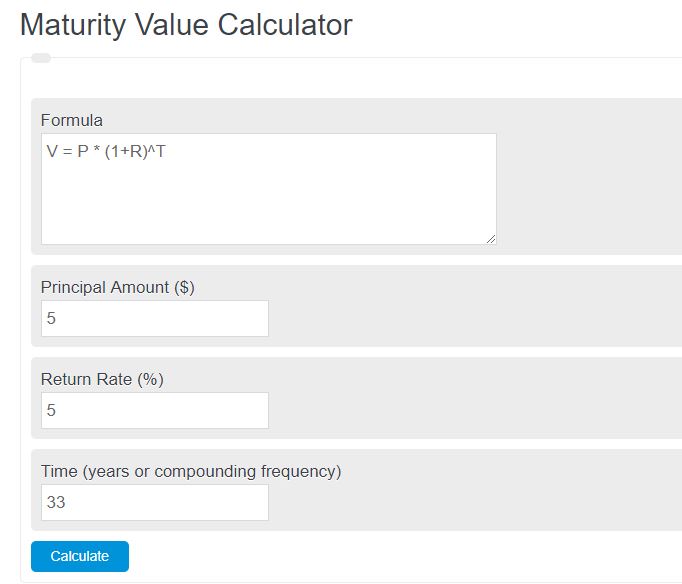

Maturity Value Formula

The following formula can be used to calculate the maturity value of an investment.

5 = P * (1+R)^T

- V – Maturity Value

- P – Principal Invested

- R – Rate of Involvement

- T – Time of Investment

Maturity Value Definition

A maturity to value is a measure of how much an investment volition make at "maturity". Maturity could be any time frame or a specific time frame designated by the investment.

Maturity Value Example

How to summate maturity value?

First, decide the total principal invested.

For this example, the total principal invested is plant to be $50,000.00.

Next, make up one's mind the rate of interest.

In this case, the interest rate is 4%.

Next, decide the total fourth dimension of the investment.

For this example, the time of the investment is v years.

Finally, calculate the maturity using the formula to a higher place:

V = P * (1+R)^T

V = 50000 * (1+.04)^5

V = $lx,832.64

FAQ

What is a maturity value?

A maturity value is a measure of the amount an investment will make at it'southward maturity time.

How to calculate maturity value?

- Commencement, determine the chief invested.

Calculate the total principal invested.

- Side by side, determine the rate of interest.

Determine the rate of involvement on the investment.

- Next, determine the time of investment.

Determine the total time of investment.

- Finally, calculate the maturity.

Using the formula above, calculate the maturity.

Source: https://calculator.academy/maturity-value-calculator/

Posted by: fieldsforomed.blogspot.com

0 Response to "How To Find Maturity Value In Compound Interest"

Post a Comment